For a detailed guide on setting up overtime via timesheets, click here.Other Information: According to the Salary Structure of the Employee, the Gross payment information, the Loan Repayment Information, and the Net Pay information will get auto-captured.

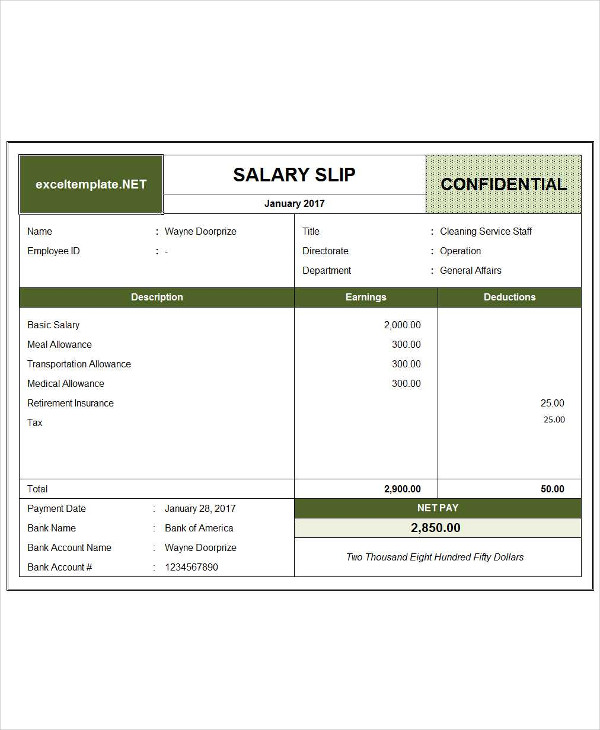

in the Salary generated from the Timesheet can be mentioned here. or Deductions like Income Tax, Provident Fund etc. Earnings and Deduction: Any Earnings like HRA, Incentives etc.Additional Details while Creating a Salary Slip form a Time Sheet: You can also more Timesheets here to create a single Salary Slip against multiple Timesheets.ġ.1. Salary Slip Timesheet: The details of the Timesheet from which the Salary Slip was created will be captured.Dates: Since this Salary Slip is getting generated out of a Timesheet, it will auto-fetch the Start Date and End Date from the Timesheet.All the details, like the Employee, Employee Name, Posting Date, Company Name, Letter Head, etc.Once the Timesheet is submitted, and an invoice has been generated, go to the Timesheet and click on 'Create Salary Slip'.How to Create A Salary Slip from A Timesheet To enable the same, you may choose to create the Employee's Salary Slip directly from a Timesheet.ġ. It also includes the items deducted from your paycheck, such as the provident fund (PF), professional tax and tax deducted at source (TDS). The salary of an employee can be calculated based on the number of hours that he has worked for on a particular project. The salary range for an Indian Post Office employee (clerk) depends on their qualification, experience, and job location. A salary slip contains different elements of your wage, such as the basic salary, house rent allowance (HRA), dearness allowance (DA) and performance-based incentives.

0 kommentar(er)

0 kommentar(er)